Table of Content

So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our insurance team is composed of agents, data analysts, and customers like you. They focus on the points consumers care about most — price, customer service, policy features and savings opportunities — so you can feel confident about which provider is right for you.

However, you can still reach out to a licensed insurance agent if you need assistance. Click on your state to get a free home insurance quote and make sure that you're fully protected. Actual Cash Value Coverage - Actual Cash Value Coverage is often cheaper and can be used for people who want their property insured but don't care for their items as much. Such terms and availability may vary by state and exclusions may apply. Identity theft protection helps defend you against fraud and identity theft and can stop damages to your credit within minutes.

Disasters by Month in Indiana

Online “insuretech” companies are insurance companies that operate completely online. They tend to be newer companies and have been founded in the digital age. They all sell workers comp insurance directly to businesses and tend to have lower rates. You can get a quote, file a claim, receive a certificate of insurance and pay your bill, all online, and within minutes.

Wind is typically one of the named perils included in even the most basic homeowners policies. This will pay the amount you need to replace your damaged items with new items. Your personal belongings are covered for specific “perils” in a standard home insurance policy.

Industries with the cheapest workers comp

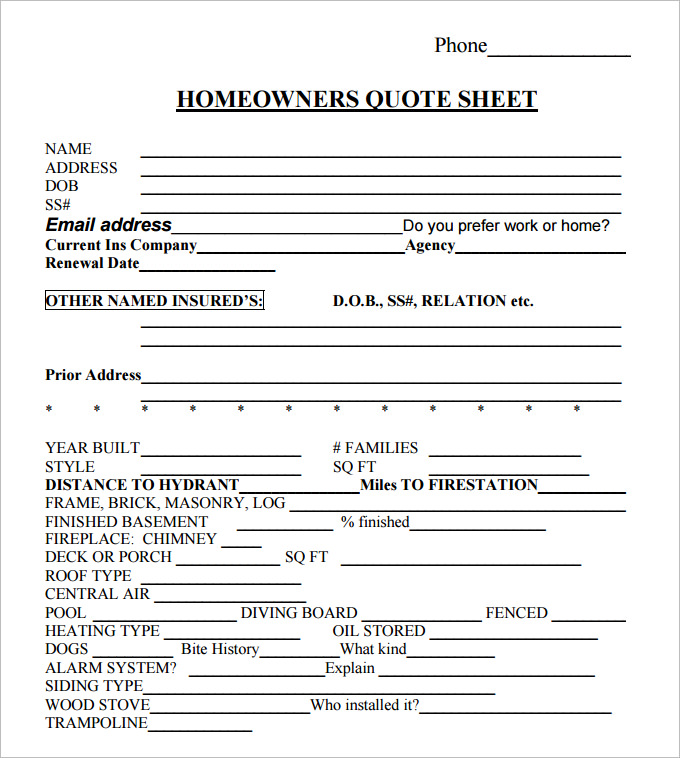

Before getting an estimate for your home insurance in Indiana, make sure you have gathered relevant information that insurers may need. Insurers will require you to provide basic personal information, such as your name, address and Social Security Number. If you own solar energy panels or have a home security system, your annual premium may change. With a poor credit rating, your home insurance prices might skyrocket. An individual's risk and the likelihood of filing a claim are assessed by insurance companies using credit-based insurance ratings.

But it’s usually pretty easy to get a quote from an online insuretech company, so you have nothing to lose (except a few minutes’ time) by getting a quote. If you want to compare several quotes in one place, we should work with Simply Business or CoverWallet. They allow you to get and compare several quotes from the top carriers in one place easily. Workers comp insurance cost varies significantly by company depending on several factors that we discuss the details below. There are a number of providers in the state that offer discounts for military families, but the best home insurance in Indiana for veterans and active military duty individuals is from USAA. This provider only caters to current and former military members in their families, giving them a unique experience that best satisfies their needs.

Best for most people: Cincinnati Financial

If you’ve never had a workers comp claim, your experience modification rate will be lower and then you’ll pay less. Safe workplaces pay less in workers compensation insurance over time. We have a few ways to improve your chances of shaving dollars off your Indiana home insurance premium. By increasing your amount from $500 to $1000, you can save anywhere from $200 to a $800 annually. If you do not have a history of making claims, then this solution may be right for you. Another way for you to reduce your premium would be to add security to your home.

The information provided on this site has been created by Simply Insurance™ for general, informational, and educational purposes. We do our best to ensure that this information is up-to-date and accurate. Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application submission and underwriting outcome. According to Neptune Flood, the average cost of flood insurance is about $700 per year or $58.00 per month.

Content & Links

MoneyGeek averaged thousands of quotes for a sample house built in 2015 with $250,000 in dwelling coverage to identify the most affordable providers in Indiana. Your coverage level is the biggest factor affecting your premiums. For a higher level of coverage, you'll have to pay more money for more coverage. Home insurance coverage for $3,000,000 costs an average of $17,379 per year in Indiana, a difference of $16,425 between lowest and highest levels. Nationwide provides the most inexpensive homeowners insurance in Indiana for a baseline dwelling coverage of $100,000, at $747 per year on average.

The cost of rebuilding your home and your insurance requirements affect your dwelling coverage level. We recommend checking quotes from at least three providers before making a purchase decision. Nationwide also offers the cheapest options for newer homes and for individuals with bad credit.

This is not the case and most of the time you are going to need to purchase separate flood insurance. Flood zones vary across Indiana, but if you have a mortgage in a designated FEMA flood zone, you’ll likely be required to have a flood insurance policy. But even if you have no mortgage, you may want to check the flood zone you are in and how common flood damage is in your area to help determine whether you need this type of coverage. You can check your flood zone with FEMA’s tool and then use that information to have a conversation with your insurance agent about your flood risk. Progressive has the best standard homeowners insurance policy Indiana. They have a range of options to choose from, and their rates are very competitive.

Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Your home purchase will be one of the most significant investments, so not covering it with insurance would be a huge mistake. Then, you’ll need to gather all of the necessary documentation, including photos of the damage and a list of repairs that need to be made. Once the insurance adjuster has approved your claim, you can begin making repairs. It’s essential to keep track of all expenses to be adequately reimbursed. Please consult your policy for the specifics of your selected coverages.

No comments:

Post a Comment